Mickael Mosse is gearing up for an imminent launch of the white label bank offer for the Brazilian market, in just a month, with no license requirements

Not a bank but want to act like one? BancaNEO can provide you with a white-label bank solution covering technology, compliance, risk management, go to market strategy and customer service. You take care of your own brand and choose the key products of your choice, we will customise, deploy and run your bank, in just a month. Your brand, your offers, our technology and our license.

Throughout the last decade, the global banking services community is living through a major re-shape. Before the 2010s, the majority of financial products were offered by giant banking chains: almost every kind of product, for any kind of customer, was given by the same hands.

The latest trends in computer technology, the deep penetration of our lives by mobile and web applications, and the digitalization of literally everything led to the need for separate consumer-level banking products with a smaller, but better set of functions. Thus, the neobanks started thriving. After them, other fintech companies started offering purpose-built products for travelers, small and medium businesses, and enterprises began to create their own financial platforms for the employees.

Mickael Mosse, CEO and Founder of BancaNEO, and one of the figures in the world of FinTech, has issued the following statement which explains the concept of BaaS in comparison with Software as a Service (SaaS): “SaaS is basically paying for applications as you use them, rather than buying them. These services used to cost you a fortune, but are now free or near enough. That’s where banking is going.”

Banking as a Service can be generally defined as an end-to-end process that ensures the comprehensive performance of a financial service that is provided online in a specified time-frame. With BaaS the traditional model shifts towards a more dynamic version that operates thanks to micro-services and APIs, which transform the nature of banking. FinTechs find an ideal outlet in entities providing BaaS and White Label Banking solutions. The latter begin as neobanks and subsequently turn into challengers. It is quite expensive and time-consuming to obtain a banking license, so the BaaS formula is the perfect opportunity to choose. A great example is N26, which initially offered its clients cards obtained through a white label from the Wirecard Bank. Banks that manage to operate and provide interesting services in the digital era are the ones gaining more users and becoming more competitive.

FinTechs all over the world are already taking advantage of the new opportunities and apply the innovative technologies to improve user experience. Microlending, marketplaces and telecommunication firms greatly rely on BaaS, API-based solutions and automatic real-time processing.

Private labeling has long been a pervasive strategy in retail, where products are made by third party manufacturers and sold under a retailer's name. The cost to manufacture is often much lower than reselling another brand name, resulting in higher margins and increased revenue for sellers.

Retailers who implement this strategy also maintain wholesale control of the brand, including packaging and pricing, which generates product exclusivity as well as promotes customer recognition of and loyalty to the brand.

Possibly the biggest benefit of private labels, however, is that they eliminate the pains of having to design and build a new product — especially when entering a new market. By outsourcing the entire process and leaving those details to the experts, sellers can instead focus on what they excel at: branding and marketing the finished product.

Because the benefits of this strategy are so multifaceted, it's no wonder private labeling is moving beyond consumer goods and gaining traction in service-based industries. Businesses looking to develop new offerings and product functionalities can now easily outsource entire technology stacks and tedious regulatory administration.

The revolution of the banking industry is expected to bring along a variety of similar solutions and opportunities for financial market participants. Many barriers that are restricting innovation today will gradually disappear and so will the security concerns that are affecting the level of customer trust. The new developments will allow individuals and companies to manage their finances more efficiently, using a range of tools that speed-up and simplify the processes.

Across industries, digital technologies are democratizing information to spur more competition and innovation. Because of this, the trend towards "open access" will only become more pervasive. In the banking industry, particularly, the open banking movement has been unfurling from its epicenter in Europe and stretching across the globe for the past few years.

How to Start a Bank? "There are still many niches that could be covered with a purpose-built banking service. Corporate banking, international transfer applications, banking for youth: in most countries, the demand is still there. However, starting up financial services from scratch requires over $20 million of investment and 2-3 years in development, not speaking of certification, countless audits, testing, due diligence, and security training, whatsoever." Mickael Mosse said.

Did all these new digital services go through it? Of course, no. They all use API based solutions provided by other banking institutions under the hood. Essentially, already certified banking providers offer their code and infrastructure to be built upon. The new companies simply build over this core with their bespoke end-to-end process, for a fraction of time and cost. This approach is called white label banking or banking as a service, depending on details.

To go with the overall speed of the process and significant cost cuts, the white label provider provides state-of-the-art technology, with all contemporary security features. The provider also sets up all connections to wire transfer networks and gets all licenses required to run such a business, which is quite complicated especially now, with the new PSD2 directive.

How Do BancaNEO White Label Solutions?

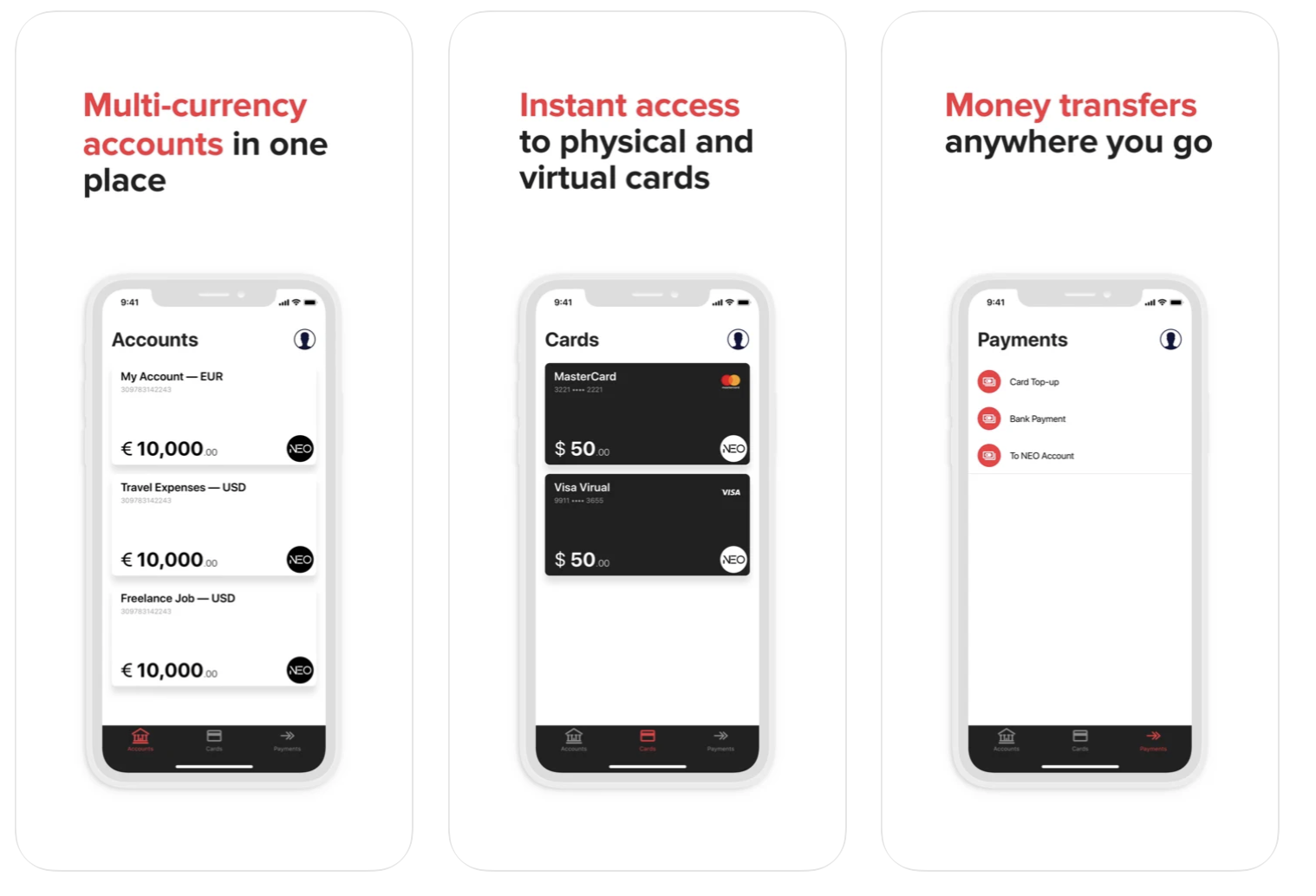

BancaNEO’s white label banking is a complete package that includes core, licensing, due diligence operations, and end-user interaction in form of web and mobile apps. Once your business decides to launch a financial product, be it for the market or for corporate use, BancaNEO can set up your financial suite and build apps with your designs in terms of just a few weeks. After all launch procedures are complete, you and your customers receive a banking application that can create and operate current accounts, receive and send money, provide an overview of all transactions, and has an Open X API to connect all sorts of financial and accounting software.

The cost of such a white label product often equals half of the commissions you impose on your customers, that white label owner collects on their behalf. With this scenario, the white label doesn’t have a say in your commissions and earns virtually the same amount of funds as you do.

After the European market, BancaNEO is now entering the Brazilian market with this game-changer solution. BancaNEO will provide a white label banking solution covering technology, compliance, risk management, go-to-market strategy and customer service. You take care of your own brand and choose the flagship products of your choice, we customize, deploy and manage your bank.

If you want to start your own bank in Brazil, or anywhere in the world, contact BancaNEO now [email protected] or visit https://bancaneo.org

This is paid content.